dependent care fsa limit 2022

If you and your spouse. See below for the 2022 numbers along with comparisons to 2021.

Fsa And Hsa Limits In 2022 What S Changing Sportrx

To be clear married couples have a combined 5000 limit.

. See more examples Use our Dependent Care FSA Calculator to see how much you can save with a Dependent Care FSA. You enroll in or renew your enrollment in your. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the.

10 as the annual contribution limit rises to. The IRS clarified that it wont tax dependent care flexible spending account funds for 2021 and 2022 that COVID-19 relief provisions allowed to be carried over from year to year. IRS Tax Tip 2022-33 March 2 2022.

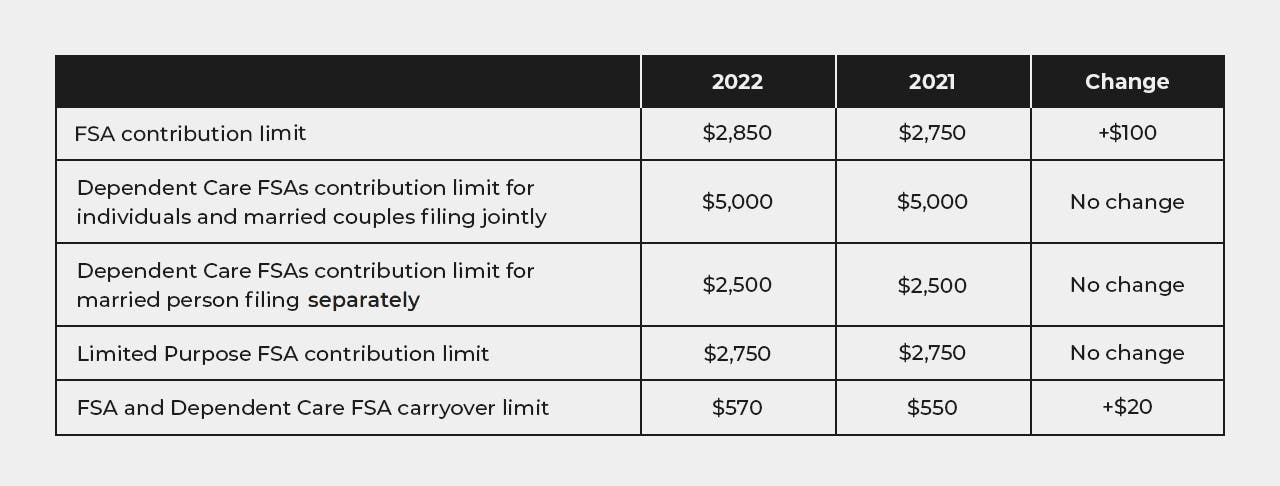

The IRS sets dependent care FSA contribution limits for each year. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing.

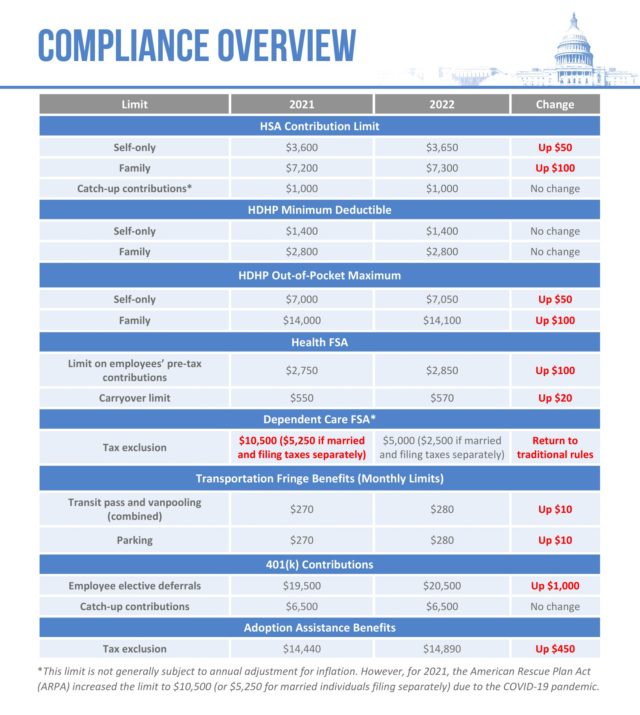

Dependent Care FSA Contribution Limits for 2022. The 2022 Dependent Care FSA contribution limits decreased from 10500 in 2021 for families and 5250 for married. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022.

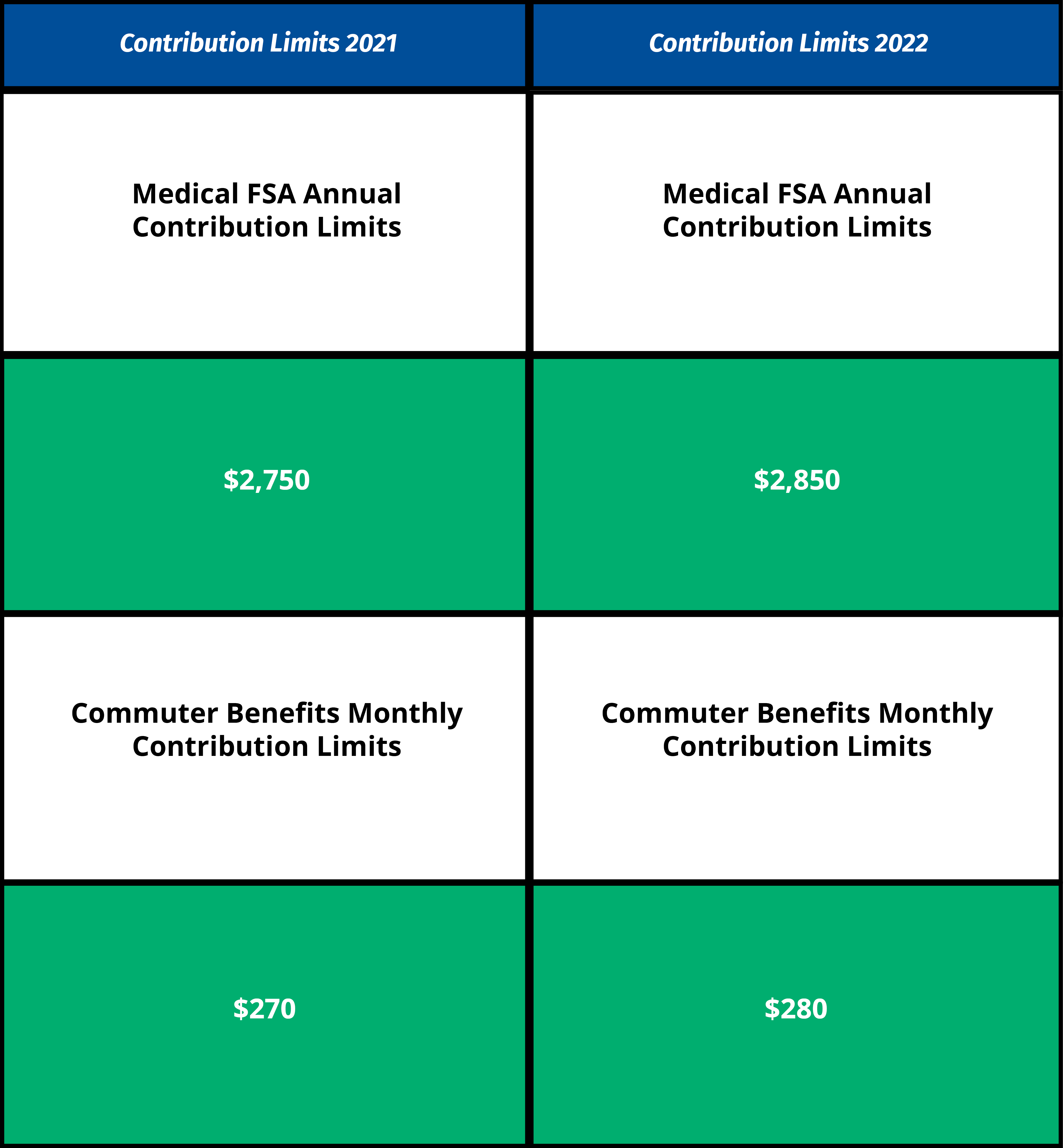

Find out if this type of FSA can help you. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. How You Get It.

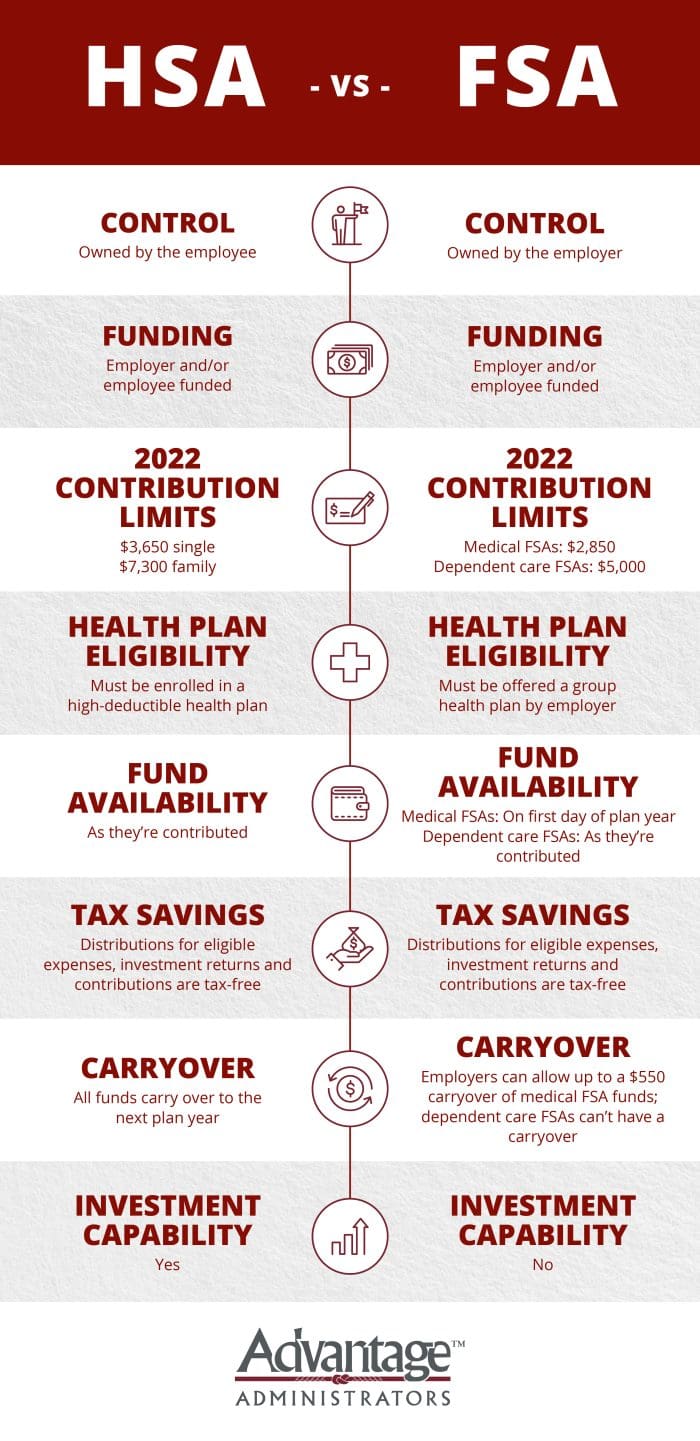

For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately. A dependent care flexible spending account can help you save money on caregiving expenses but not everyone is eligible. The carryover limit is an increase of 20 from the 2021 limit 550.

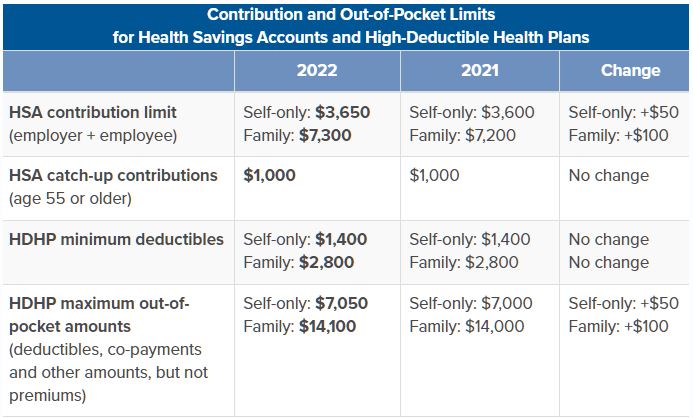

The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. In addition Emily used the. If you have a dependent care FSA pay.

So if you had 1000 in your account at the end of this. Employers may allow a full carry-over of remaining balances for next year up to the total balance in the workers FSA. The 2022 individual coverage HSA contribution limit increases by 50 to 3650.

The 2022 family coverage HSA contribution limit increases by 100 to 7300. Contribution limit on a health flexible spending arrangement FSA. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately.

Emily an employee of Oak Co had 4500 deducted from her pay for the dependent care FSA. For 2022 the IRS caps employee contributions to 5000. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child.

Hsa Vs Fsa See How You Ll Save With Each Advantage Administrators

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Dependent Care Fsa Wex Inc

2022 Hsa Contribution Limits 2 Core Documents

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Employee Benefit Plan Limits For 2022

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What The New 2022 Hsa Limits Mean For You The Difference Card

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Why You Should Consider A Dependent Care Fsa

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

2022 Retirement Plan Contribution Limits

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning