nebraska sales tax calculator vehicle

Nebraska car tax is 285943 at 700 based on an amount of 40849 combined from the sale price of 39750 plus the doc fee of 299 plus the extended warranty. Request a Business Tax Payment Plan.

Fuel Taxes In The United States Wikipedia

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

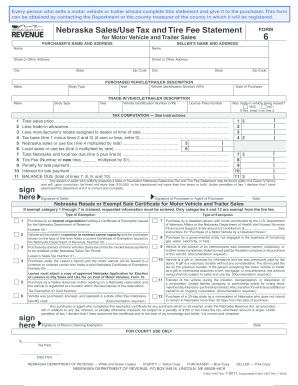

. The statewide sales tax for nebraska is 55 for any new or used car purchases. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. Via email from the Sarpy.

26 rows Tax Calculator. The percentage of the Base Tax applied is reduced as the vehicle ages. There are two ways to request an estimate of the cost to register a vehicle.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. The information you may need to enter into the tax and tag calculators may include.

The Nebraska sales tax on cars is 5. Money from this sales tax goes towards a whole host of state-funded projects and programs. Nebraskas motor vehicle tax and fee system was implemented in 1998.

Before that citizens paid a state property tax levied annually at registration time. The statewide sales tax for nebraska is 55 for any new or used car purchases. The vehicle identification number VIN.

Maximum Possible Sales Tax. Nebraska vehicle tax calculator. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

The Nebraska sales tax on cars is 5. The date that you. Driver and Vehicle Records.

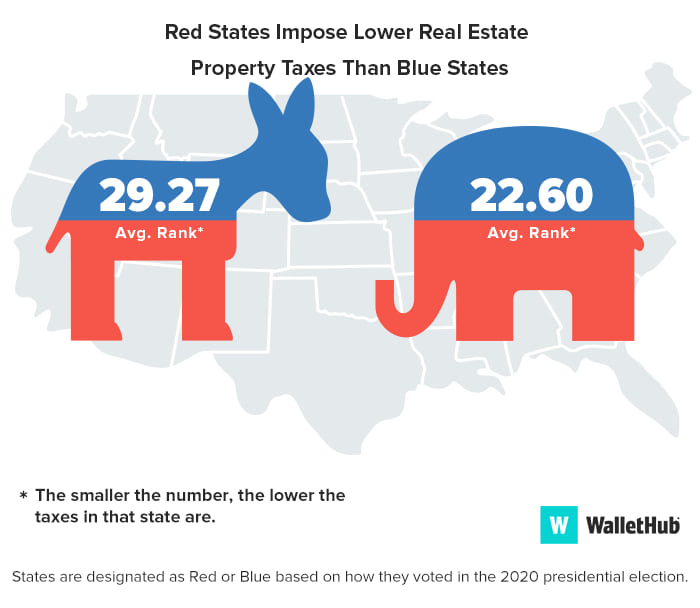

In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

The Nebraska state sales and use tax rate is 55 055. Sales and Use Tax. How Does Sales Tax Apply to Vehicle.

Calculate Car Sales Tax in Nebraska Example. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. Average Local State Sales Tax.

Online on the Nebraska DMV website which provides the estimate immediately. The make model and year of your vehicle. Sales Tax 60000 - 5000.

Registration Fees and Taxes. Make a Payment Only. The cost to register your car in the state.

Sales Tax Rate Finder.

Sales Tax Calculator Credit Karma

Nj Car Sales Tax Everything You Need To Know

Nebraska Auto Taxes And Fees To Watch Out For Woodhouse Nissan

Vehicle And Boat Registration Renewal Nebraska Dmv

Sales Taxes In The United States Wikipedia

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska Income Tax Ne State Tax Calculator Community Tax

Vehicle Registrations Nebraska Department Of Motor Vehicles

How To File And Pay Sales Tax In Nebraska Taxvalet

11 9 Sales Tax Calculator Template

Registration Fees And Taxes Nebraska Department Of Motor Vehicles

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Your Guide To The United States Sales Tax Calculator Tax Relief Center

How To File And Pay Sales Tax In Nebraska Taxvalet

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012